how much do you need to retire

In 2022 the income limit is 19560 if you have not reached your full retirement age or 51960 in the same year you will reach full retirement age. It assumes you own your own home are relatively healthy and allows for some receipt of the Age Pension.

|

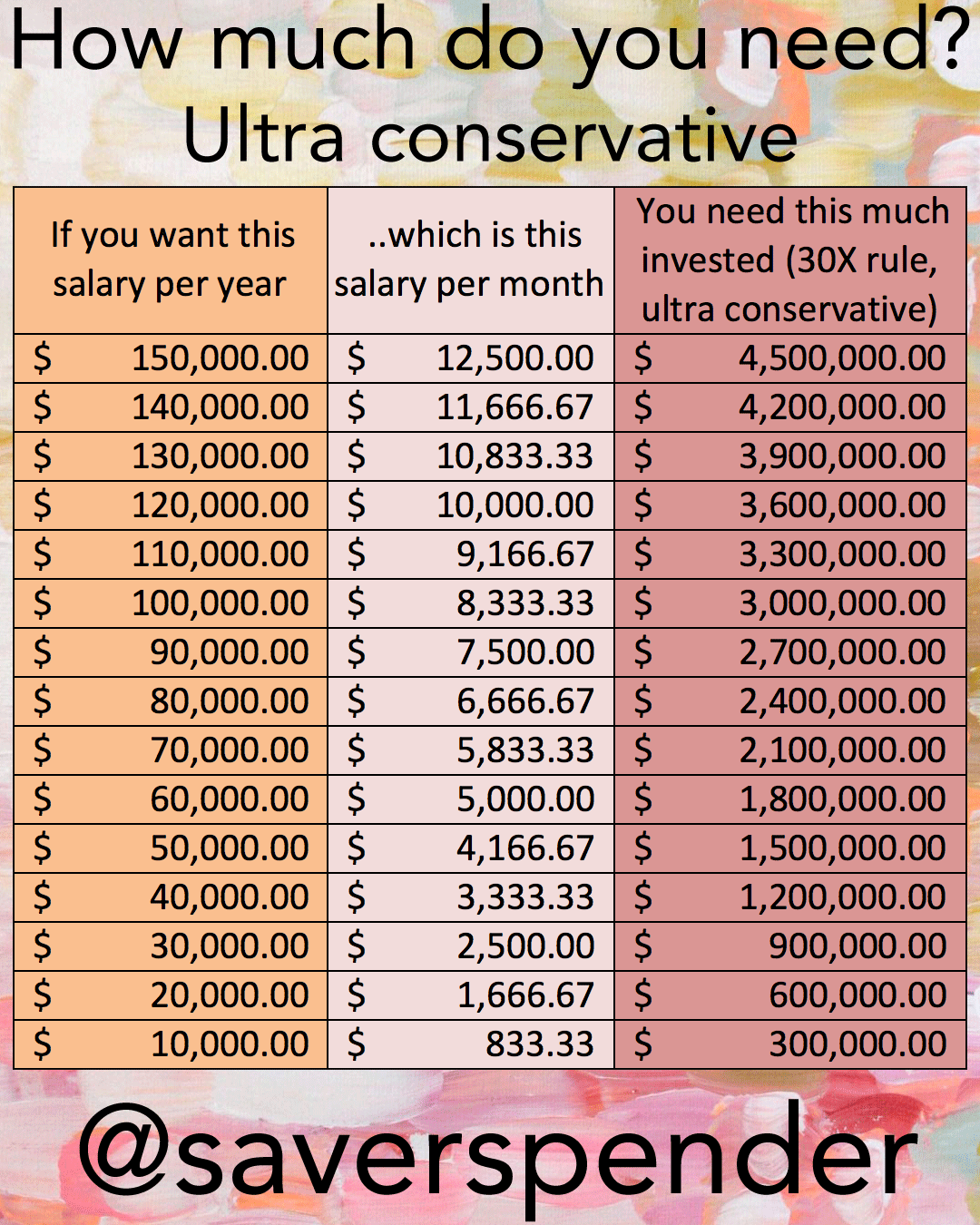

| How Much Do You Need To Have Saved For Retirement By Salary Per Year And Investments Save Spend Splurge |

Knowing your super balance is a crucial part of planning for retirement as its likely to form a.

. As you can see there are a couple of states. The mean retirement income in the US for households is 67238 and the median income is 43696 US Census Bureau 2017. How To Retire At 50. Our nifty retirement calculator will show you the projected income youll need based on the lifestyle youd like to have in retirement.

You may have heard you need 1 million or that you should have enough savings to provide an income equal to 70-80 of your final salary. By that math you would need 388800 total to pay your bills for a decade until the. In June 2021 these estimates were. Then there is the ASFA.

Portfolio withdrawal rates But what does. It all depends when you want to retire the. How much should you save into your pension. So lets assume thats your minimum.

People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle. To determine just how much you will need to save to generate the income that you need one easy-to-use formula is to divide your desired annual retirement income by 4. To retire your combined retirement nest egg will need to reliably generate roughly 75 of that amount or about 150000 per year. 545000 needed in retirement savings at age 65 to meet this.

Retiring aged 60 with 500000 could work for some whereas others may feel they can retire comfortably with 300000 aged 55. 70 if you are typical and do not have a mortgage and up. No matter the type of lifestyle you want to lead when you retire your options will be limited by the size of your pension pot. If youre close to retiring use the budget planner to estimate how much money.

This rule estimates that you will need between 70 and 100 of your pre-retirement income in retirement. How much you need to save depends on how you want to spend your retirement. There are a few different ways to work out how much super you need for the lifestyle you want in retirement. For instance if a.

Set your retirement goals. How much money will you have in retirement. The larger the pot the more it can pay out. An annual income of 38880.

640000 needed in retirement savings at age 65 per couple to meet this. Your age when you retire. Its important to note that if you retire before your full retirement age and continue working your Social Security benefit may be reduced if you make more than the annual.

|

| How Much Money Do You Need To Retire In Bali Best Estimation |

|

| How Much Do I Need To Retire At 55 62 65 70 Or At Any Age Market Consensus |

|

| Overcoming The Fear Of Retirement Holborn Assets |

|

| Calculating How Much Money I Need To Retire Homeequity Bank |

|

| How Much Do You Need To Retire Well Canadian Business |

Posting Komentar untuk "how much do you need to retire"